Indian Income Tax Department has announced that the system of PAN (Permanent Account Number) will change in 2025 PAN Card Update 2025. Such reforms will be geared towards enhanced transparency, prevent duplication and enhance linking between PAN and Aadhaar. By July 1, 2025, the Aadhaar authentication will have become obligatory and that new applications of PAN and those who already have a PAN should have their cards attached to Aadhaar by December 31 2025.

In case you are going to apply to a new PAN card or have not already connected your PAN with Aadhaar, the given article of Small Hills Pancard Services will inform you about all the information you should know about the new rules and their advantages, terms, and how to remain up to date.

According to the Income Tax Bill 2025 announced by Finance Minister Nirmala Sitharaman and recent CBDT Notification No. 25/2025, Aadhaar authentication will be mandatory for new PAN applications from July 1, 2025.

Quick Summary: From July 1, 2025, Aadhaar verification will be mandatory for new PAN applications. All existing PAN holders must link Aadhaar by December 31, 2025, or their PAN will become inactive.

Index

0.Introduction

1. Aadhaar Now Mandatory for New PAN Applications

2. PAN–Aadhaar Linking Deadline: December 31, 2025

3. PAN 2.0 – A Smarter, Safer System

4. How These Changes Benefit You

5. What You Should Do Now – Action Checklist

6. Frequently Asked Questions (FAQs)

7. Conclusion

1. PAN Card Update 2025 Aadhaar Now Mandatory for New PAN Applications PAN Card Update 2025

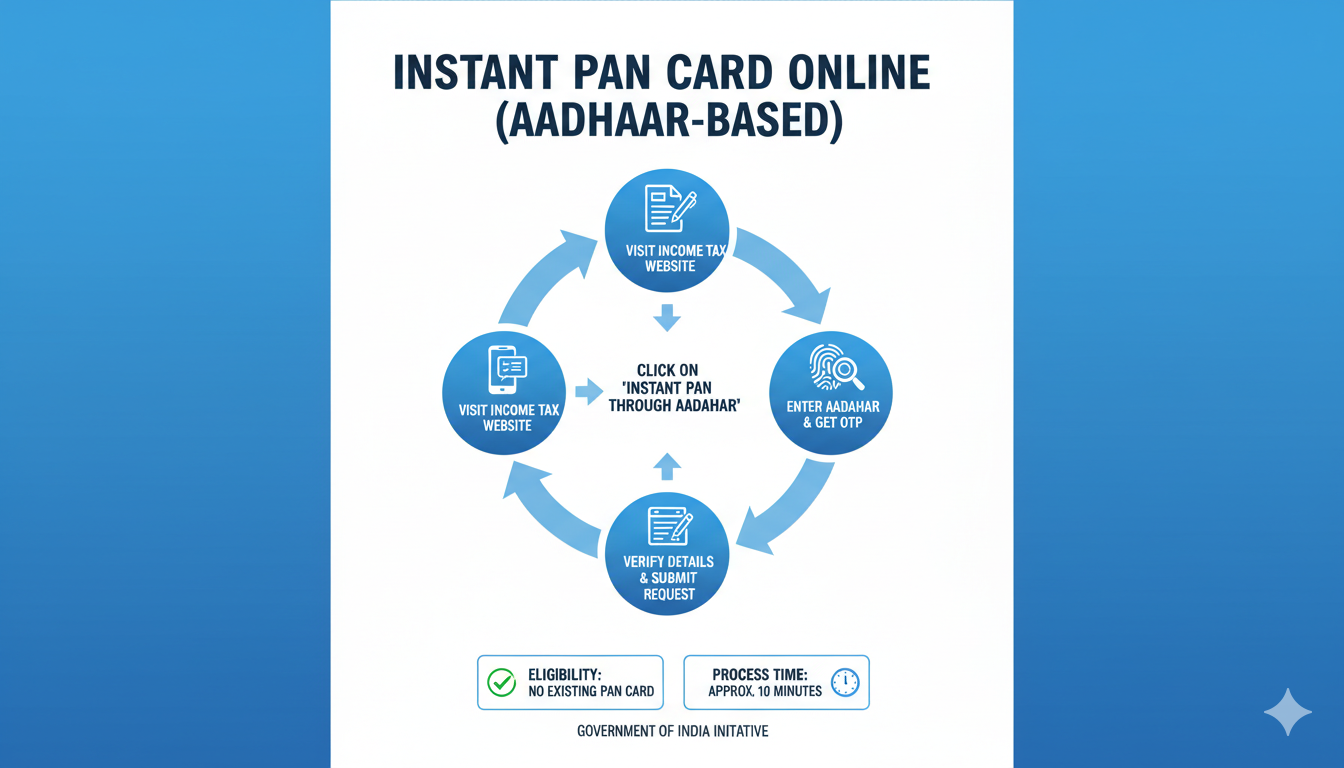

Aadhaar authentication will be compulsory to any person who wants to have a new PAN card as of July 1, 2025. It will mean that applicants will have to verify their identity using Aadhaar number and undergo an OTP-based e-verification using a mobile number linked to Aadhaar.

This is implemented to discourage counterfeit or duplicate production of PAN cards as well as to ensure that a PAN card has a discrete and identifiable identity attached to it. The government also finds the relocation useful towards realization of an objective of integrating the digital identity systems into tax, banking and finance systems.

2. PAN–Aadhaar Linking Deadline: December 31, 2025

In the event that you already have a PAN card, it is worth remembering that you have until the end of December 31, 2025, to ensure that the two are linked with your Aadhaar number. Otherwise, your PAN will stop its operation by January 1, 2026.

Among the most crucial activities that may be prevented by a failed PAN are:

- Filing income tax returns

- Opening a bank account/demat account.

- Carrying out transactions that are over 50,000.

- Checking credit in case of loan or property purchasing.

Today, you are required to join your PAN and Aadhaar to escape the fines or interruption of the services with the approved service providers or official e-filing portal.

3. PAN 2.0 – A Smarter, Safer System

The government is also deploying a modernized form of the PAN infrastructure, the PAN 2.0, along with the updates on the rules. This upgrade is based on the security, automation, and speed.

Key features include:

- Quick verification QR coded PAN cards.

- Fraud detection based on AI in order to avoid misuse.

- Voluntary collaboration with the DigiLocker and e-KYC systems.

- Increased PAN allotment and correction services in less time and paper-free.

The current PAN cards will not be lost and the back-end system will be migrated to a single digital platform that will simplify all the PAN operations.

Visual suggestion-3: Comparison image between the traditional PAN card and the upgraded PAN 2.0 card with QR code highlights.

4. PAN Card Update 2025 How These Changes Benefit You PAN Card Update 2025

The PAN and Aadhaar integration have several advantages both to the taxpayers and service providers:

- Single identity, many purposes: Aadhaar-based PAN helps banks, mutual funds and digital platforms to implement KYC.

- More rapid verification: Aadhaar -based OTP verification gets rid of delays and manual errors.

- Improved security: Minimizes fraud and identity duplication through biometric data tie-up.

- Apple-to-apple: Now, through trusted agencies such as Small Hills Pancard Services, all PAN services, including new applications and corrections, can be done online.

These reforms will help to make the tax ecosystem in India more transparent, efficient and easier to use.

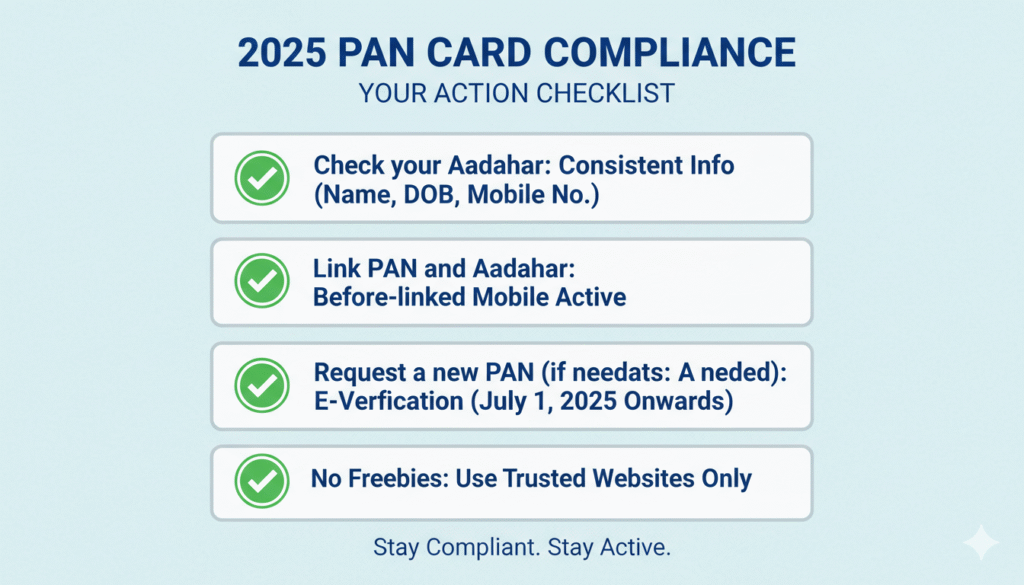

5. What You Should Do Now – Action Checklist

The following is a basic checklist to be in compliance with the 2025 PAN card rules:

Check your Aadhaar: Also make sure that the information (name, date of birth, mobile number) is consistent with the PAN records.

Link PAN and Aadhaar: You need to do it before December 31, 2025, or your PAN will become inactive.

Refresh your contacts: Get your Aadhaar-linked mobile number active to receive OTP.

Request a new PAN (where necessary): You can use your Aadhaar to do e-verification at the time of application since the 1 st of July, 2025.

There are no freebies: Only apply or link your PAN with trusted websites or authorized service providers.

Visual suggestion-5: A checklist graphic with each action point ticked.

6. PAN Card Update 2025 about Frequently Asked Questions (FAQs) about PAN Card Update 2025

Q1: Do I need a new PAN card after July 2025?

No. Existing PAN cards remain valid. You just need to link them with Aadhaar before the deadline.

Q2: What happens if I don’t link PAN and Aadhaar?

Your PAN will become inoperative from January 1, 2026, preventing you from completing essential financial tasks like filing returns or opening accounts.

Q3: Can NRIs or foreign nationals apply under the new rules?

Yes, but Aadhaar requirements differ. NRIs can apply using Form 49AA; Aadhaar is only mandatory if they possess one.

Q4: Is there an offline option for PAN application?

Yes, you can visit authorized PAN centers, but even offline applications will require Aadhaar authentication once the rule takes effect.

Conclusion

The 2025 rule modification of PAN card is a significant step towards the Indian digital identity security and tax transparency. The government is planning to make Aadhaar verification compulsory in new applications as well as linking all existing PANs to simplify compliance and avoid misuse.

To the individuals and businesses, these updates come as a relief to the operations as they reduce the errors and enhance identity security. Being ahead of the due dates will save time and have the banking and financial services continuously available to you.

In case you are yet to apply PAN card or have questions or when connecting your PAN with Aadhaar, Small Hills Pancard Services can help you.

Need help applying or linking your PAN card?

Chat directly with Small Hills Pancard Services on WhatsApp — Click Here to Start Your Application

🌐 Visit: https://smallhillsagency.com

📞 Do you want to apply for a PAN card? Contact or WhatsApp Now : +91-7097871137

Instagramhttps://www.instagram.com/smallhills_pancard_services/